How to manage your finances successfully

Learn how to create an expense tracking spreadsheet.

What will we see in this post

Many people are aware of the importance of financial management, as being financially organized and investing in the future is key. But this is only possible when all of the money coming in and going out is kept track of.

If you’re reading this post and think that, even without careful financial management, you know how much you spend every month on average; don’t be surprised if after you perform all the calculations you realize that most of your revenue is being used with transportation or food apps, for example.

Also, if you’re a freelancer or influencer, the importance of separating your professional from your personal expenses is even greater, because there’s a variation in revenue from month to month, but many overheads do not change on a regular basis.

Therefore, if you wish to get financially organized and be in the black, check out our tips below!

The reasons for creating an expense tracking spreadsheet

Knowing the exact amount of one’s monthly income is normal, even if they don’t work for a fixed income. But when it comes to their spending amount, most people can’t give you an exact amount.

Digital work has an independent aspect to it when compared to the traditional market, but it also requires financial organization, and the best way to do so is by using a spreadsheet.

Of course, there’s no need to use complex spreadsheets, since it is one aspect that discourages tracking, but keeping an eye on your monthly expenses will help you plan new achievements.

A spreadsheet also allows you to calculate several metrics, such as ROI, by using a few formulas.

Return on investment is one of the most used financial metrics by businesses to measure their return on investments, thus demonstrating the brand’s financial health.

Therefore, in order for the business to operate and allow you to make decisions, it is necessary to plan, have reserves for investments and have working capital to keep your brand on the market, even when things aren’t so good.

Starting this organization from scratch can be difficult, but there are programs and applications that simplify the task. On your pc, you can use Excel or Google spreadsheets, which update the amounts online and store them on the cloud.

In addition, certain mobile apps, such as Mint, Wallet and My Budget Book help create payment reminders, integration with credit/debit cards and with your bank account, and send alerts when your expenses exceed predefined amounts.

4 advantages of organizing your spending

With their financial life up to date, entrepreneurs can feel more secure and comfortable to make new investments, pay their bills on time and avoid unpleasant surprises. Check out other advantages of keeping your financial management on track:

1. Establish long-term goals

Only by using an organized spreadsheet will you be able to set future goals. Do you know how much you can invest right now? Do you have an emergency reserve or are you setting money aside to achieve a dream?

Financial management helps you set goals because it objectively shows how much is coming in and going out. Thus, you’ll be able to set monthly goals, for example, so that at the end of the year you can save up a certain amount.

2. Have quick access to important information

By organizing your data, you’ll be able to consult it in an easy and convenient manner. Therefore, we recommend that you use spreadsheets on your PC or mobile apps.

Thus, by updating and monitoring cash inflow and outflow, you know on which dates you’ll be paid, how much you can still spend during a given month, or by how much you have exceeded your limit.

4. Cut expenses

Once you’ve organized the information and have calculated your expenses, you can make cuts because you’ll be able to analyze what your costs and expenses are.

Fixed costs include rent, utilities, the internet, phone, and food, which are all hard to cut or reduce.

Expenses, on the other hand, are easier to cut. You can cut back by using your transportation app less, eating out only on weekends and buying new clothes only on special occasions.

5. Making decisions

In order to make decisions and make a financial commitment, you need to have your accounts up to date.

In this manner, financial organization allows you to make long-term investments, take out loans whenever necessary and make purchases with installment plans because from your spreadsheet data, your expected earnings and expenses are already planned out.

Learn how to control your spending in 3 steps

As we said earlier, we recommend that you become financially organized by using a spreadsheet.

Check out below how to control your expenses by using Google Sheets!

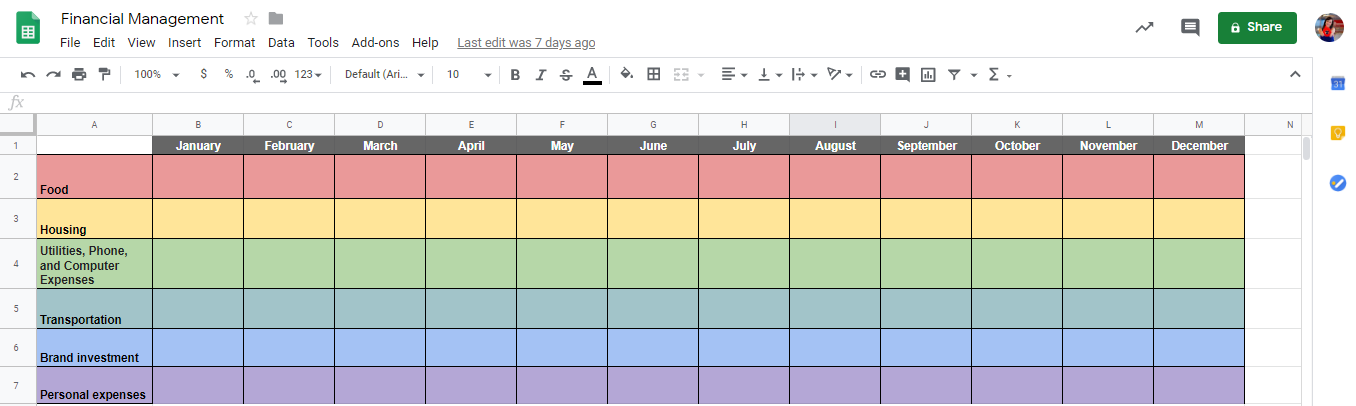

1. Create the spreadsheet

Divide your spreadsheet into months and expenses. At the top, name 12 columns with the months of the year.

On the side, you should enter all of your expenses, such as food, rent, utilities, transportation, brand investments, personal expenses, etc.

2. Map your cash inflow and outflow

This part might take longer because you’ll need to recall and map all of your expenses and cash inflows for the month.

First of all, start with amounts received. Enter every amount that you’ve received either cash, bank transfers or checks.

After a while, you’ll be able to enter this information into the mobile app to update your table when you have the time.

Mapping cash outflow is easier. Find your receipts, go to your account’s transfer area and check your credit card statement.

It’s important that small cash expenses also be entered. A cup of coffee, dessert after lunch and drugstore purchases might seem unimportant, but when you add them all up, they can represent a large portion of your budget, which can be cut.

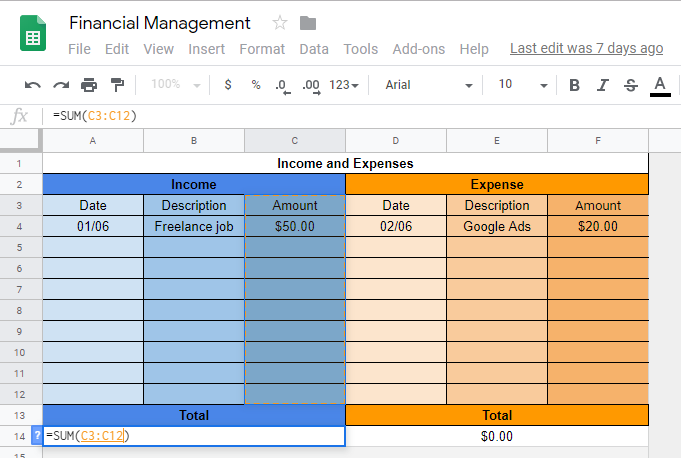

3. Add the cash outflows and compare them with the inflows

In the last row of your table, you can create a formula by using the “sum” function, which will show, in an organized manner, how much was spent during the month.

Just enter =SUM (), and within the parentheses, enter the line x column range you wish to add; or click on Insert > Function > SUM.

Look at the example below:

Now, you know how much you received and how much you spent. This allows you to define the points where you need to save money or how much you wish to set aside every month.

A few months after you’ve organized your account, you’ll be able to create expense goals and analyze other information. For example, you’ll be able to analyze the months in which your expenses are higher, and those in which the most revenue was received.

In addition, whenever your budget is in the black, don’t leave money sitting in your bank account. Invest in treasury bonds, for example.

Financial management as a tool for success

Rarely will we find successful entrepreneurs and influencers who don’t have good control of their spending. Although it’s hard work at first, you’ll realize that it’s worth it and that it provides great benefits.

These actions will show you expenses you were unaware of, and habits that can be changed without a change in lifestyle, for example.

Having good financial controls is key for digital producers, as is the need to analyze and quantify your actions on the internet.

To learn more about the subject, please check out our post on metric analysis and keep an eye on your results!