International sales at Hotmart: expand your global scope

Hotmart Producers have made sales in more than 188 countries. Check out how to expand your business to other countries.

What will we see in this post

Did you know that it’s possible to bring your online course, e-book, or other forms of digital products to all global world? By using Hotmart, you can reach students from different countries and significantly expand your content.

In this article, we will explore how the international sales process works with Hotmart while we are ensuring you are up to date with our business model, and all necessary tax and tax obligations comply, besides.

Let’s explore this fascinating universe and discover the global market opportunities offered for your infoproduct!

International Sales: getting started

By first, you should understand that an international sale works like a national sale (for the purchaser): the person accesses the product’s payment page, makes the purchase and automatically receives the access information in their email.

As another important point, Hotmart’s sales system can be relied on, regardless of the country where the sale takes place. This is a fully integrated system into the platform that sells in more than 188 countries and has an exclusive anti-fraud system.

Hotmart’s sales system is developed to meet all the digital product market specificities, and it performs thousands of transactions simultaneously with high performance.

In addition, this solution offers relevant advantages for those who want to sell outside their origin country. Let’s see the main ones:

- Sales in 22 currencies

- +40 local payment methods

- Language localization in 9 languages

- Payment with two credit cards

- Subscription payments

- Automatic commission slipt for Affiliates

- Creating Coupons

Why sell to other countries with Hotmart?

When talking about international sales, it’s not enough to offer payment in dollars. The buyer should have the same experience as a local customer. That’s why the advantages listed above are so important. The person should be able to shop with a national card, or with a payment method they are used to and in their own currency, without having to worry about conversion and international shopping fees.

For example, when selling digital products in Colombia, it is possible to offer the payment option via Efecty, besides other possibilities such as a credit card. So, your customers have the choice that best suits their needs. In the same way, if the sales are in England, you can offer the option to pay by BACS.

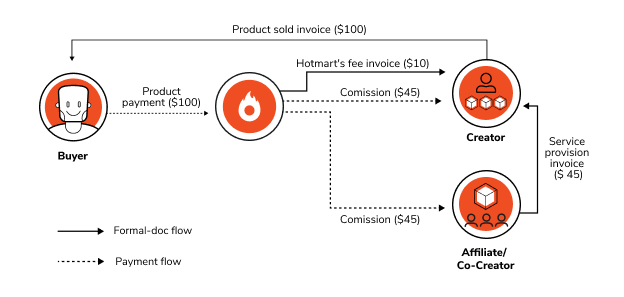

How does Hotmart’s business model work for international sales?

If you are selling or want to sell to international customers, it is very important to be aware of the updates taking place in Hotmart’s business model.

The initial changes were focused on sales to Colombia, but by 2024, all the countries Hotmart sells to will also be part of this business model update.

Hotmart acts as an agent for producers in sales to Colombia, representing them before buyers, co-producers and affiliates.

Those who sell to Colombia have the flexibility to define their business strategies, being able to have more autonomous tax management and better cash flow management.

In addition, producers have the possibility to determine the nature of their product, which may result in potential benefits from tax regimes and exemptions.

In practice, producers who make sales to Colombia have a direct relationship with their buyers and are responsible for determining, calculating, declaring and paying taxes, as well as invoicing each sale, such as the operating model already exist for local sales in Brazil.

For this reason, only local sales made by producers in Brazil, in Reais, will not undergo changes, because those transactions are made with Hotmart as a representative in a similar model.

Co-producers and affiliates have a direct relationship with the producer they work with, and are responsible for addressing tax issues that may apply to the services provided.

The following image illustrates how this dynamic works:

Tax and fiscal management of international sales

In order to manage your tax and fiscal obligations in every country where your product is offered, it’s best to seek guidance from your accountants and lawyers..

It’s crucial to remember that tax rules differ depending on the producer’s location, the buyer, and the product sold, among other factors.

In order to stay updated with regulatory obligations you have to understand the location of your buyers, in which countries will your products be taxed, and what possible obligations arise from these sales, with the support of an accounting specialist, of course.

If you plan on making or want to make sales to Colombia, this recommendation is crucial.

Where you can search for tax stance for international sales?

Our recommended partner’s content can help you stay updated on Hotmart’s business model updates for sales to Colombia.

In a webinar promoted by Hotmart, Baker Mackenzie, one of the largest law firms having extensive knowledge on how to handle taxes globally, responded to a series of questions about the subject.

The fiscal scenario in Colombia and its implications for those selling to the country were contextualized by Baker Mackenzie representatives. Potential tax benefits for digital services were also a topic at the meeting.

In our Help Center, you can find the key questions regarding Hotmart’s sales model to Colombia. Please also read the General Terms and Conditions of Use and the General Payments Policy.

How to issue international sales invoices?

As a producer, you are free to define and structure your tax strategy for international sales.

It is important to note that as you are responsible for the tax aspects of your business, you must ensure that all processes, including the issuance of invoices, follow legal and tax rules.

Therefore, Alegra is a good choice if you are aware of the importance of having an automated platform for issuing sales invoices to Colombia after seeking tax guidance.

With this platform you can combine the ease of automated invoice issuance with legal compliance in several Latin American countries.

With Hotmart integration available for Colombian businesses (learn more in the webinar below), Alegra is ready to issue your Colombia sales invoices directly to your buyers, without you having to worry about it.

Another possibility is to use Hotmart sales reports and integrate via API with other invoice issuing tools.

Zapier, for example, is an automation solution capable of connecting your Hotmart account to your preferred accounting tools and platforms, making it easier to send and receive important information for your tax and fiscal management.

How to withdraw international sales commissions?

Your bank account registered on our platform will receive all the commissions available for withdrawal every month and automatically. The transfer can be made in any currency without a withdrawal fee.

In other words, you have the benefit of receiving your commissions once a month, which are available for free withdrawal.

You are still able to request withdrawals on the platform anytime you want, even though the payout is automatic and free. In order to request more withdrawals on the platform, you will have to pay a withdrawal fee to cover bank charges.

Check out the withdrawal step-by-step:

- Access Hotmart account on this link: https://app.hotmart.com/login

- In the left side menu, click on Balance.

- If you have an available balance in USD or EUR, click on the Withdraw an amount button on the right.

- On the new screen, choose the account in which you want to receive the amount.

- Enter the withdrawal amount. Keep in mind that the minimum withdrawal amount in USD or EUR is 20.00 + 1.99 withdrawal fee, in the selected currency.

- Click Calculate.

- To finish, click Make a withdrawal